-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Our Products More business product links

Bank accounts

- Business current account

- Business choice account

- Switching business accounts

- Compare all business accounts

Savings accounts

Loans and Finance

- All Treasury solutions

Treasury solutions

Help and support

- Online Banking More online banking links

BusinessOnline

- Commercial More commercial business links

Business enquiries

Contact us about a general enquiry.

- Corporate and Structured Finance More corporate business links

Corporate and Structured Finance

SME Cashflow Finance

Unlock your cash flow potential. At Yorkshire Bank we take a flexible approach to business borrowing.

Lending is subject to status and eligibility.

- Our Sector Expertise More sector expertise links

SME Health Check Index – Q2 2017

< back to all business news articles

07/09/2017

SME Health Index score rises again

SMEs account for 99.9% of businesses in the private sector. Those 5.5 million businesses are the engine room of British industry and the stability of the economy is dependent on their success.

They contribute 47% of the total revenue across all UK businesses. It’s estimated that around 15.7 million people work for a private sector SME – roughly 60% of the UK’s total employment.

The second installment of our SME Health Check measures the health of the macroeconomic environment for SMEs in Q2 2017, to get an insight into how they’re doing.

Some key results

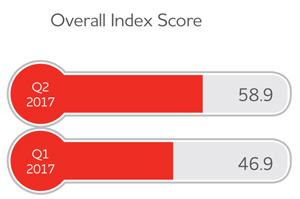

- Moving in the right direction – The SME Health Check Index rose from 46.9 in the opening quarter of 2017 to 58.9 in Q2. This is the highest reading since the final quarter of 2015.

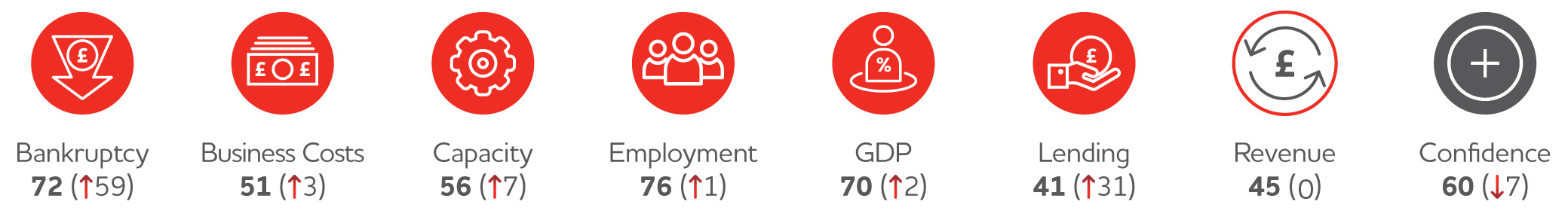

- Mostly positive – Six of the eight sub-components on the SME Health Check Index have improved since the previous quarter.

- Fewer bankruptcies – Bankruptcies are the biggest rise in score, up 59 points. That is the highest value in over two years. The number of companies entering insolvency fell 11% on the same quarter a year ago.

- More lending – Lending has gone up 31 points in the index to 41 – the highest score since late 2015. Lending to SMEs sits at £94.6 billion, up 0.2% from previous quarter. Lending was a particularly bright spot in the South West and South East.

- Confidence wobbles – Confidence dropped by seven points, the biggest sub-component drop in Q2. Despite this, confidence remains higher than it was throughout 2016.

Regional results

Yorkshire and the Humber recorded the largest downward movement in the rankings, falling from second place in Q1 2017 into ninth position in the second quarter. While scores have fallen across the board, this is partly down to the positive performance in Q1. A bright spot in the data was the first increase in SME lending in a year, with data from the BBA showing a 0.4% quarterly rise.

In the previous quarter, Wales topped the Health Check leaderboard. This quarter Wales have fallen to second in the index rankings, as the North East moved into first place with a 19 point increase – the first time the region has taken the top position since data collection began in 2014.

“Official regional trade statistics suggest that the weakness of the pound is translating into stronger demand for Welsh exports.”

Wales secured a top three ranking for the fourth consecutive quarter. Business confidence with Welsh SMEs has risen slightly since Q1 and remains at a historically high level, boding well for the coming months. Official regional trade statistics suggest that the weakness of the pound is translating into stronger demand for Welsh exports.

The biggest change regionally was a 26 point improvement for Northern Ireland and 24 point increase in the West Midlands. The only overall negative drop in score was in Yorkshire & the Humber, who dropped 1.4 points – but the region did have a very strong performance in the last quarter.

The regional breakdown of the SME Health Check Index revealed that SMEs in the North East and Wales fared better than those in other regions. At the bottom end of the regional rankings were Northern Ireland and the North West, despite the business and economic environment for SMEs in these regions having become more favourable since the first quarter of 2017.

View UK SME health check report Q2 2017 (opens in a new window)

POSTED IN: 2017

SHARE

Related Articles

You are here: Business Banking > Business News > Articles

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

- Modern Slavery Statement

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.