-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Our Products More business product links

Bank accounts

- Business current account

- Business choice account

- Switching business accounts

- Compare all business accounts

Savings accounts

Loans and Finance

- All Treasury solutions

Treasury solutions

Help and support

- Online Banking More online banking links

BusinessOnline

- Commercial More commercial business links

Business enquiries

Contact us about a general enquiry.

- Corporate and Structured Finance More corporate business links

Corporate and Structured Finance

SME Cashflow Finance

Unlock your cash flow potential. At Yorkshire Bank we take a flexible approach to business borrowing.

Lending is subject to status and eligibility.

- Our Sector Expertise More sector expertise links

Leveling the playing field for female entrepreneurs across the UK

< back to all business news articles

31/07/2019

It’s encouraging to see gender equality firmly on the radar for so many UK businesses, with the gender pay gap and other movements driving the agenda. Yet, as a nation, we still have some way to go before we reach an entirely level playing field.

Despite having a more pessimistic outlook on business growth in general, compared to their male counterparts, many female entrepreneurs are thriving.

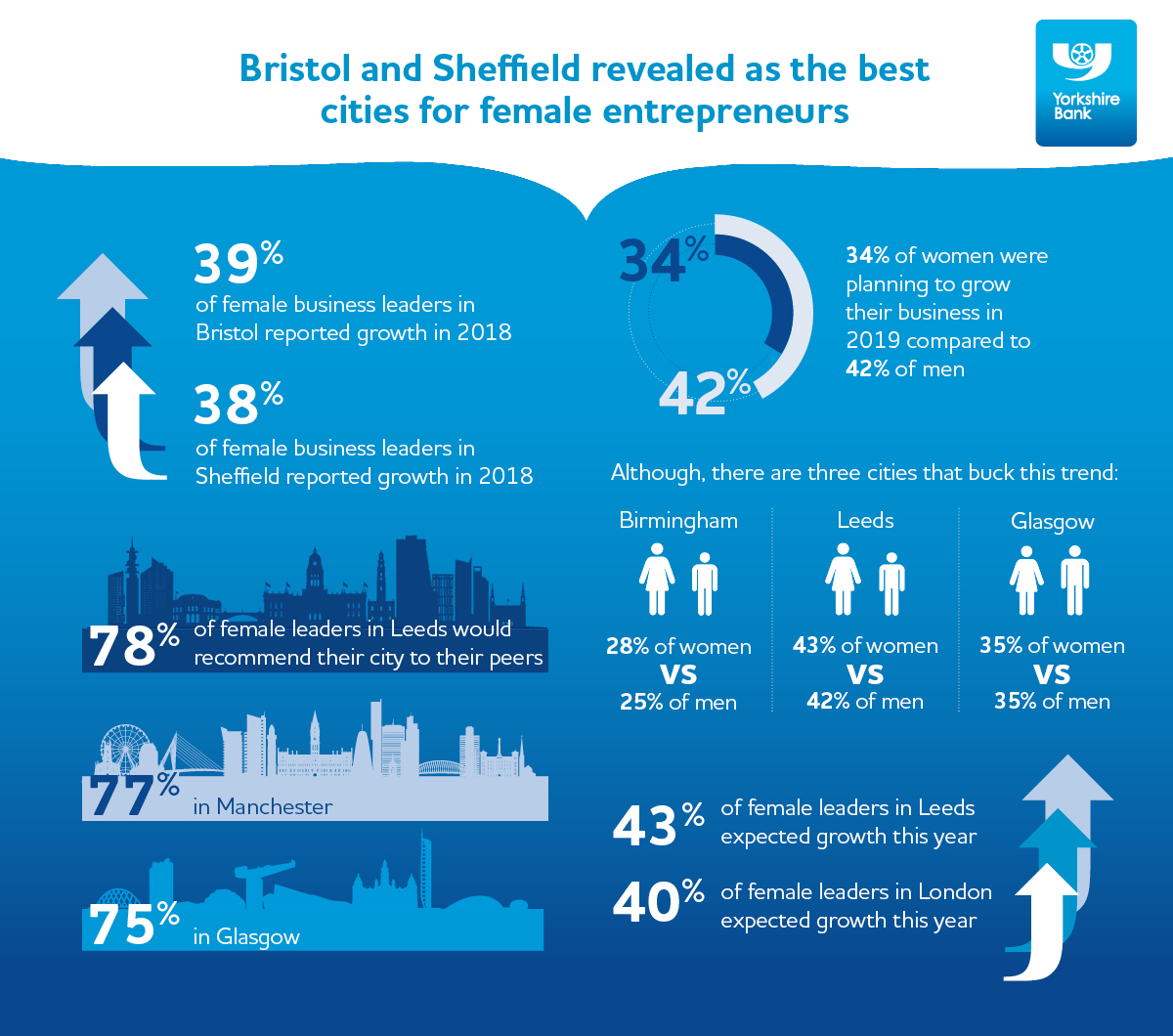

Our research, Expect More, has shown that Bristol and Sheffield are leading the way as the best cities for female entrepreneurs during the past 12 months. Bristol tops the leaderboard with 39% that reported growth, and Sheffield very closely behind with 38% reporting growth.

Liverpool was revealed as the city with the biggest growth gap - 49% of male business leaders grew their turnover last year compared to only 33% of female business leaders. However, Leicester achieved a level playing field across both female and male entrepreneurs.

Future growth

When looking ahead, female leaders in Leeds were the most optimistic about the future: 43% expected growth this year. London came second at 40%, despite being the city where women experienced the least growth in 2018 (31%), showing the ambition of business leaders in the capital.

However, the research found that 34% of women were planning to grow their business during the course of 2019, compared to 42% of men. There are three cities that buck this trend: in Birmingham, it’s 28% of women vs 25% of men, in Leeds it’s 43% of women vs 42% of men and Glasgow reveals an even split with 35% for both.

The ongoing challenges women face when starting up or growing a business continue to be reported more widely in the UK media. Balancing home and work, building confidence and dealing with sexism remain prevalent themes in the UK. And recent research from the ISM (International School of Management) in Frankfurt has reinforced the fact that women are still more likely to encounter problems with confidence and obtaining finance, and tend to be more critical about their own capabilities and skills.

In addition, it was found that it’s more likely for women to face a work-family conflict, and struggle more to counterbalance their different roles when committing to new business ventures.

Our own research found that Leicester based SMEs are the most likely to recommend their city to their peers at 78%, followed closely by Leeds (77%), Manchester and Glasgow (75%). These recommendations were based on factors including the overall sense of business community, availability of partners and suppliers, and the talent pool.

The research hints that one of the reasons for the growth gap could be unequal access to funding: almost a quarter (24%) of women report they find it easy to access funding for growth, compared to a third (32%) for men.

Thinking big

The possible knock-on effect is whether women-led businesses today run the risk of focusing on more local or regional opportunities, rather than thinking nationally or even internationally. We found that 60% of female entrepreneurs operate on a local or regional scale, vs 54% for male business owners. It’s not just a UK issue: it’s widely reported that female entrepreneurs are not exporting enough on a global level. An International Trade Centre survey in 2018 across 20 developing countries found that just 20% of exporting private companies are owned by women.

Samantha Bedford, Head of New Ways of Working, CYBG, said “The business community is incredibly strong and supportive, particularly in the North, as shown by our recent event, The Festival of Technology & Innovation, in Manchester. One of the sessions was a lively panel discussion on diversity, which reinforced how the Northern business community helps each other to reach their growth goals, and I have no doubt that the North will continue along its positive path in the months ahead.”

“There are still disparities between male and female entrepreneurs on a national level. Our research has shown that a larger proportion of females are finding it difficult to receive the funding they need and that’s an area we can work on, to try and close the growth gap and support the wider ambitions they have for their businesses.”

Susanna Lawson CEO of Manchester tech firm, OneFile said: “As a female tech founder in Manchester I’m surprised Manchester isn’t top of the list! From my experience talking to women business owners, on the whole, they seem very positive about growth. There is a real appetite to scale up and plans in place to do so. Diversity in tech and in business in general is such an important subject and I was really pleased to see it at the forefront of the recent Yorkshire Bank Festival of Technology & Innovation event and participate as a panelist.”

Survey findings

By approximately how much did you grow last year (in terms of turnover)? Those who answered growth increase

By how much do you plan to grow your business over the next year (in terms of turnover)? Those who answered percentage growth:

How easy / difficult do you find it to access funding for growth?

Supporting small businesses

At Yorkshire Bank, we provide a range of products and services to help you grow your business and handle your finances. Find out more by clicking here.

POSTED IN: Case Studies

SHARE

Related Articles

You are here: Business Banking > Business News > Articles

- About Yorkshire Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

- Modern Slavery Statement

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Yorkshire Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.